The country’s economy, like many, is reeling from the effects of the COVID-19 pandemic, although it has not directly had a major effect on farm output.

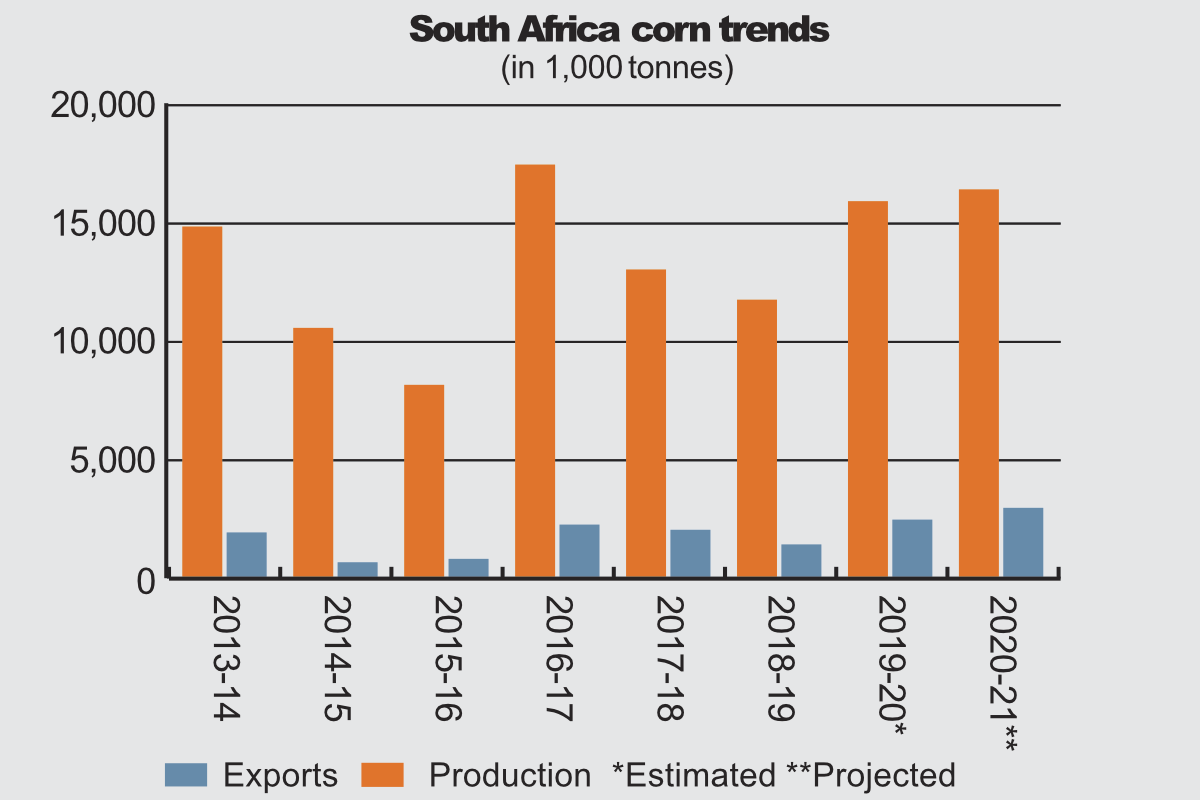

The International Grains Council (IGC) puts South Africa’s total grains production in 2020-21 at 18.6 million tonnes, up from 18 million the previous year. The total includes 2.1 million tonnes of wheat, compared with 1.5 million in 2019-20. The country’s corn crop in 2020-21 is put at 15.8 million tonnes, down from 16 million the year before.

“Helped by regular showers in recent months, production prospects remain broadly favorable,” the IGC said of the country’s corn crop.

A forecast sorghum crop of 100,000 tonnes in 2020-21 compares with 200,000 the previous year.

South Africa’s total grain imports in 2020-21 are put at 2.2 million tonnes, down from 2.9 million the year before. Its grain exports are forecast at 2.8 million tonnes, up from 2.1 million. Forecast imports include 1.9 million tonnes of wheat, down from 2.4 million in 2019-20. Exports include 2.7 million tonnes of corn, compared with 1.9 million the previous year.

The USDA attaché said in an Oct. 29, 2020, report that, for corn, “relatively attractive local corn prices, progressive exports and favorable weather forecasts are influencing producers planting decisions positively.”

“Local corn prices are trading at more than 30% higher than a year ago, giving commercial producers an incentive to plant more fields to corn,” the USDA said. “Expectations are that local corn prices will remain at relative high levels for the rest of this year.”

The attaché also noted that corn exports are progressing at a favorable rate and decreasing local stock levels.

“Expectations are that corn demand in the Southern Africa region could increase in the coming months, specifically from Zimbabwe,” the report said. “South Africa, with ample corn stocks, is in the perfect position to supply the region.”

A further factor was that “favorable weather conditions for the season (a La Niña weather pattern) are forecast over most of the summer rainfall areas of South Africa, which adds to optimism and is influencing producers planting decisions positively.”

However, the attaché forecast a “marginal increase in the commercial demand for corn in the 2020-21 marketing year to 11.6 million tonnes as South Africa’s economic growth will be under pressure in 2021 due to the COVID-19 pandemic and structural and policy constraints.”

The report gave a figure of 11.4 million tonnes for demand the previous year. It cited high corn prices as one reason for limited demand growth, with demand for feed limited by the effect of a shrinking economy on demand for animal protein.

“White corn, in the form of a meal, is the staple food for many South African households, especially for lower income consumers, as it is a relatively inexpensive source of carbohydrates,” the USDA said.

In a March 23, 2020, report, the attaché said South Africa’s wheat area has stagnated at around 500,000 hectares per year with an average yield of 3.3 tonnes per hectare. The report did not see any major shift from this trend in 2020-21, as producers prefer to plant more profitable crops such as canola, oats, corn and soybeans.

“However, in some areas, especially in the Western Cape Province, wheat production is still the most competitive crop to plant,” the attaché said. “South Africa’s annual wheat consumption increased on average by about 1% per annum the past 10 years.”

The USDA forecast 2020-21 wheat consumption in South Africa at 3.35 million tonnes.

“Due to slow economic growth and a bumper corn crop, which will lower the price of corn meal, major increases in the consumption of wheat products are not foreseen,” the USDA said. “Consumers can substitute rice, wheat, and corn products based on price and taste preferences.”

Oilseeds

In an annual report on the oilseeds sector dated April 3, 2020, the attaché said that “under normal climatic conditions and taking into account average yields, South Africa could produce 800,000 tonnes of sunflower and 1.4 million tonnes of soybeans in the 2020-21 marketing year.”

This represents an increase of 9% in sunflower seed and 8% in soybean production from the previous year. It forecast that there would be a record 1.3 million tonnes of locally produced oilseed meal available in 2020-21, but that the sluggish economy would limit demand to 1.7 million tonnes, with exports falling by 8% to 550,000 tonnes, while imports of vegetable oil would fall by 5% to below 400,000 tonnes on increased domestic production and limited demand growth.

“South Africa’s trade in soybeans and sunflower seeds are generally relatively small as local production is destined mainly for local processing and imports are directed to oil and protein meal,” the USDA said. “For example, South Africa’s trade in sunflower seeds in the 2018-19 marketing year was less than 1,000 tonnes, while soybean imports were only 9,098 tonnes and exports 5,336 tonnes. Soybean imports were mainly from Zambia and Mozambique, while exports were destined for Zimbabwe.

“Soybean meal and sunflower meal are the major protein meals used by feed manufacturers in South Africa and represent more than 90% of protein meal usage. The average inclusion rate of oilseed meal in feed rations is about 20%. Corn is the major product used by feed manufacturers with more than 50% inclusion rate in feed rations.”

Biotech

South Africa has a robust and experienced regulatory system for genetically engineered (GE) products, which started with the publication of its ‘GMO’ act in 1997, the attaché said in an Oct. 14, 2020, report.

“This enabled South Africa to be placed in the top 10 of largest producers of GE crops in the world and by far the largest in Africa,” the USDA said. “The production area of GE corn, soybean, and cotton in South Africa is estimated at around 3 million hectares. Almost 90% of corn plantings, 95% of soybeans plantings, and all cotton plantings in South Africa are with GE seeds. South Africa possesses a highly advanced commercial agricultural industry based, inter alia, on first-generation biotechnologies and effective breeding capabilities.”