It’s easy to feel lost while in conversations about nanotech, biotech, remote sensing, and ag marketplace. These are all agricultural technologies (AgTech), and they are not typically on the spectrum of where venture capital (VC) is invested.

However, one thing is becoming clear. If you are involved in AgTech, you should now be figuring out your role in the Fourth Industrial Revolution (4IR) space. If not, you are at risk of being late to the party.

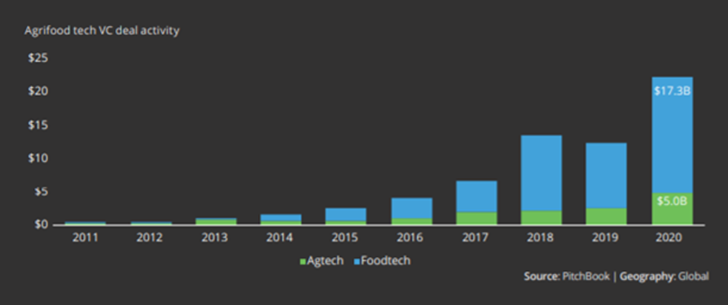

AgTech is the application of technology to horticulture, agronomy, and livestock, in other words, agriculture. Finistere noted in their 2020 Agrifood tech investment review how venture capital investments in agriculture have been growing in prominence and in volumes since 2011. This is significant as agriculture is traditionally a sector where venture capital (investments in start-up companies with volatile yet large growth potentials) are overshadowed by investments in established operations with stable yet marginal growth potential.

VC investments into AgTech all around the world are proving that agriculture is on the cusp of taking its place in the 4IR.

Source: Finistere

Where does private equity come in?

Private equity (PE) is fairly common in agriculture as it looks to invest and take equity in established companies with large growth potential.

It differs from VC in that VC is a form of PE. VC prefers early phase or start-up investing, whereas PE prefers later phase investing. A good example of a PE investment is the South African company Aerobotics, which recently received equity of $17 million in investments form Naspers Foundry, Cathay AfricInvest Innovation, FMO: Entrepreneurial Development Bank, and Platform Investment Partners.

Where the VC is going in AgTech

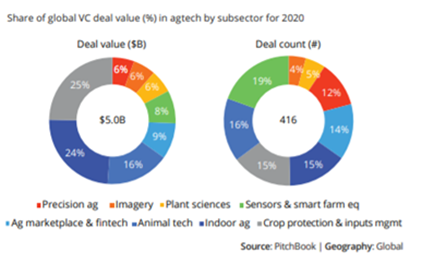

The horizons of venture capital investments are extremely broad in agriculture. Typically, AgTech investments can be categorised into one of the following:

- Precision ag

- Imagery

- Plant sciences

- Sensors and smart farming

- Ag marketplace and fintech

- Animal tech

- Indoor ag

- Crop protection and inputs management

These kind of ventures in agriculture struggle to attract PE investment, commercial debt funding or other funding, as they have a limited track record, a short horizon of invoices to finance against and applications are not widely adopted. VC takes a view on these constraints and concludes that investing in certain early phase companies is worth the risk.

It is clear that there are substantial rewards for early adopters that can part with an investment sum into an AgTech company that has passed its risk tolerance tests and due diligences.

Source: Finistere Source: Ondigitalmarketing

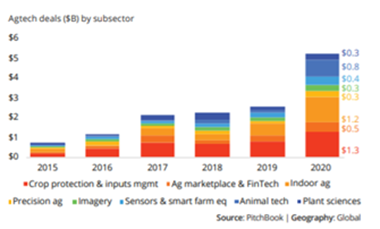

The cost of investing in AgTech or companies increases the longer one waits.

What the VC money is being spent on

In 2020 AgTech deals had grown to $5 billion (416 deals) up from $1.2 billion (~235 deals). The subsectors of AgTech receiving the lion’s share of the investment, are:

- Crop protection and input management ($1.25 billion)

- Indoor ag ($1.2 billion)

- Animal tech ($800 million)

- Ag marketplace and fintech ($450 million)

Source: Finistere

How does SA fare?

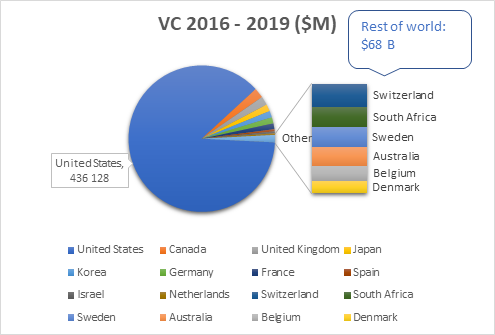

From data available on all OECD (Organisation for Economic Co-operation and Development) countries, the US ranks first in VC investments (total VC, not only in AgTech), with $436 billion between 2016 and 2019. South Africa ranks 12th, with $1.2 billion over the same period.

It’s clear that the majority of the VC deals are happening in the US ($436 billion) versus the rest of the world ($68 billion). South Africa is an international competitor in the VC investment space, and in the PE investment space. VC into AgTech will naturally follow suit.

Source: OECD

Source: OECD

Want to know more?

Contact us on This email address is being protected from spambots. You need JavaScript enabled to view it. subject line “AgTech Article” so that you can take your next step into the 4IR space.