In this blog post, I will briefly reflect on South Africa’s recent weekly grain data releases and also on the upcoming 2020/21 production season, leaning on the United States Department of Agriculture (USDA) data that was published on Friday evening.

SA weekly grain data

The producer deliveries data for the week of 04 September 2020 showed that roughly 83% of the expected maize crop of 15.5 million tonnes of 2019/20 season had been delivered to commercial silos, and the quality of the crop is mainly good. Also, a greater share of the 2019/20 soybean and sunflower seed crop had already been delivered to commercial silos. This is clear from the producer deliveries data, which have slowed in recent weeks, while the sum nearly equals the expected harvest in both crops. In the coming months, I will change the focus from summer crops to winter crops when its harvest begins. This will probably be towards the end of the year, and by then, the focus on summer crops will be on the upcoming 2020/21 production season, and on that crop conditions, not producer deliveries.

However, the weekly grain trade data will remain key for both maize and wheat throughout the year. I will touch on oilseeds and other small grain trade data around month ends, which is when the data is usually released by the South African Information Services.

South Africa exported 46 092 tonnes of maize in the week of 04 September 2020. About 51% of this went to Vietnam and the rest to South Korea and Southern Africa markets (primarily Eswatini, Mozambique, Zimbabwe, Botswana and Lesotho). This placed South Africa’s 2020/21 total maize exports at 1.31 million tonnes, which equates to 49% of the seasonal export forecast (2.7 million tonnes). The leading markets thus far are the Southern African countries (Zimbabwe, Botswana, Mozambique, Lesotho, Eswatini and Namibia), mainly for white maize, and Japan, Taiwan, Vietnam and South Korea for yellow maize. About 75% of all maize exports thus far is yellow maize, with 25% being white maize.

Moreover, South Africa is a net importer of wheat and brought in 49 457 tonnes from Russia in the week of 04 September 2020. This placed South Africa’s 2019/20 wheat imports at 1.65 million tonnes, which equates to 92% of the seasonal import forecast (1.80 million tonnes). The 2019/20 marketing year ends this month. The leading suppliers of wheat to South Africa thus far include Poland, Germany, Lithuania, Russia, Ukraine and Latvia, amongst others.

2020/21 maize production season

The USDA has painted a fairly positive outlook of 14.0 million tonnes for South Africa’s 2020/21 maize production, although this would be 13% lower than the 2019/20 harvest. This projection accounts for both commercial and non-commercial maize. Admittedly, it is too early to know where the maize harvest will be in 2020/21 as the planting intentions data for the season will only be released on 28 October 2020. That said, the projected 14.0 million tonnes is plausible in an environment that might present above- normal rainfall, coupled with higher commodity prices to encourage increased planting. Moreover, this is well above the 10-year average total maize production of 12.9 million tonnes in South Africa, and domestic annual usage of about 11.2 million tonnes.

This means, a crop of this size would enable South Africa to remain a net exporter of maize in 2021/22 marketing year, which will begin in May 2021. For domestic consumers, this would mean that we are in for a period of prolonged relatively lower food price inflation.

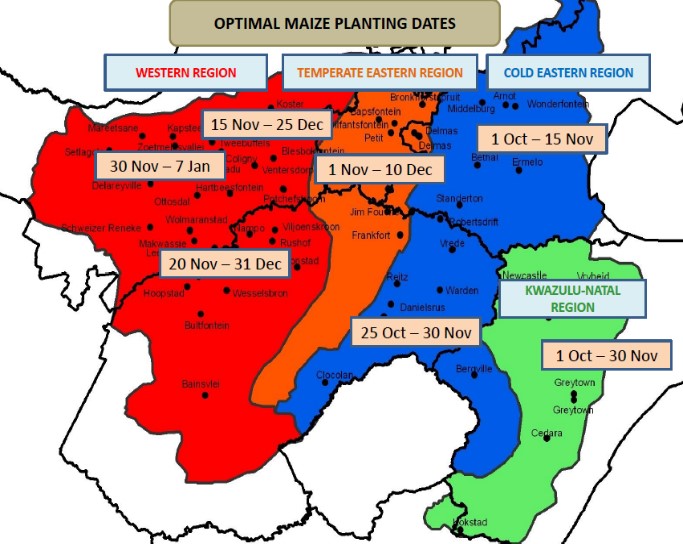

Exhibit 1 below illustrates South Africa’s maize optimal planting dates. In the recent past, the country hasn’t kept up with this schedule because of delayed rainfall. But the South African Weather Service has recently indicated that the country could receive rainfall from this month, which would then enable planting from the traditional dates.