World Farming Agriculture Commodity news - Weekly Updated - Exclusive and just that one step ahead.

News you can Trust- and that one step ahead when it come to commitment and deliver.

This year, farmers have remained cautiously optimistic about the outlook of the agricultural sector. This cautious stance has been fuelled by climatic uncertainty from the 2023/24 El Niño weather and the political uncertainty that comes with an election year. Although these uncertainties still linger on, climatic models have reported the arrival of ENSO-neutral conditions, with La Niña forecast at 85% chance from November 2024 to January 2025. On the political front, the landscape seems to be gradually taking shape from progress made in the partnership talks. Due to these factors, the agricultural machinery sales are largely expected to moderate after the excellent sales levels experienced over the past few years. In May 2024, tractor sales of 566 units were 14% lower year-on-year (y/y). Year-to-date tractor sales are now almost 22% down y/y. 25 combine harvesters were sold, 40 units less y/y. On a year-to-date basis, combine harvester sales are now almost 61% down y/y. Industry expectations for the 2024 calendar year are for tractor sales to be between 15-20% down y/y. Statistics South Africa released data showing that consumer food price inflation slowed down to 4.3% in May 2024, from 4.4% in the previous month. This deceleration was primarily driven by softening prices of bread and cereals, dairy and eggs, oils and fats, and sugar rich foods. However, over the coming months, there might be a slights uptick in consumer food price inflation driven by grain-related food products.

The European Commission's proposed tariffs on Ukrainian egg imports into the European Union would force producers in Ukraine to cut output or search for new markets, Reuters reported, citing local poultry breeders on Thursday. The commission spokesman said on Wednesday the tariffs would be introduced within the next two weeks after a previously agreed annual threshold for those imports was reached. The EU has set limits for certain agricultural imports from Ukraine after free-trade access, granted to help the country's economy following Russia's invasion in 2022, angered farmers in the EU and prompted a wave of rural protests this year. "If a decision is made..., Ukrainian products will lose their competitiveness in the EU market, which will inevitably lead to a reduction in exports," Serhiy Karpenko, executive director of Ukraine's union of poultry breeders, told Reuters. He said the duty would make trade unprofitable for producers and force them to reduce output or increase exports to other markets. Karpenko said finding new markets "is currently extremely difficult due to logistics problems, a significant rise in price and limited opportunities for exporters to be accredited." The producers' union said reduced export volumes will definitely have a negative impact on the Ukrainian trade balance and foreign currency earnings, as well as worsen the financial situation of producers. Ukrainian agriculture has been hard hit by the Russian invasion. The Kyiv School of Economics estimates that the total value of destroyed agricultural assets since the beginning of the invasion at $10.3 billion.

This week, the rand averaged R18.15/US$, stronger by 2.4% w/w and 1.2% y/y. The rand strengthened to below R18/US$ midweek for the first time in 11 months. This came as prospects of the country moving into a stable Government of National Unity (GNU) drove positive sentiment. • This week’s Brent crude oil price averaged US$84.32/barrel, up by 2.6% w/w but down by 8.5% y/y. The Brent crude oil price firmed from lower US crude oil inventory and a moderation in US jobs that increased hopes of a earlier Federal Reserve interest rate cuts. • Relative to the oil prices seen last month, the price of Brent crude oil has largely decreased this month, while the exchange rate has remained relatively stable. As a result, the following local fuel price decreases are predicted for 03 July 2024: petrol (95 unleaded) by 82c/l; diesel 500 ppm and 50ppm by 16c/l and 11c/l, respectively

This week, the yellow maize price averaged R3 946/ton, down by 0.7% w/w but up by 1.1% y/y. The white maize price averaged R5 014/ton, down by 2.7% w/w but up by 30% y/y. Maize prices were pressured by the stronger rand. • Chicago maize prices traded lower from lower than expected Brazilian and US maize export projections. • In week-07 of the domestic 2024/25 maize marketing year (MY), 5.9 million tons of white and yellow maize had cumulatively been delivered. In the same week, cumulative exports of white and yellow maize reached a combined 217 319 tons. • The top three export destinations of white maize were Zimbabwe (65 584 tons), Botswana (33 203 tons), and Namibia (22 628 tons). The top three destinations of yellow maize were Zimbabwe (39 513 tons), Botswana (11 310 tons), and Mozambique (9 990 tons).

This week, the soya bean price averaged R8 897/ton, down by 1% w/w but up by 11% y/y. The sunflower seed price averaged R8 802/ton, down by 2% w/w but up by 3.1% y/y. • Domestic oilseeds prices traded lower from the stronger rand. • Chicago soya bean futures traded higher on US crop ratings, and hot weather. • Cumulative domestic oilseed deliveries by week-16 of the 2024/25 MY stood at 1.66 million tons of soya bean and 518 276 tons of sunflower seed.

The wheat price averaged R6 155/ton, down by 4% w/w and by 7.6% y/y. • Wheat prices were pressured by the stronger rand. • In week-37 of the local 2023/24 MY, cumulative deliveries were at 1.976 million tons. • In the same week, cumulative wheat imports stood at 1.258 million tons, with 358 833 tons coming from Poland, 315 328 tons from Lithuania, and 206 850 tons from Russia, amongst others.

USA

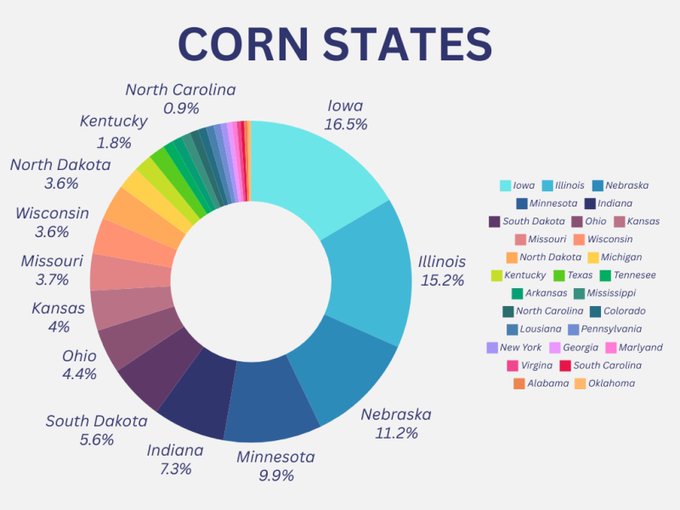

The eastern corn belt may be dry, but many other key growing areas are receiving a TON of rain. They give you an idea of what % of production each state produces. The second chart is the same. Only categorized by wet, dry, or both. As you can see, it is a lot of the bigger producing states that are receiving rain. Such as Iowa who accounts for nearly 17% of all production. Then you have Minnesota, Nebraska, and South Dakota. 4 of the top 6 producing states are receiving great amounts of rain. Meanwhile, it is a lot of the smaller producing states that make up for the production areas that are dry. Nearly 53% of corn production is wet, where as 42% is dry. Part of the reason why the market has not cared too much about the eastern dryness is that many of the big players are indeed getting good rain. Such as Iowa. To go along with that, some models like the GFS are showing rain two weeks from now.

Grains

| INDEX | UNITS | PRICE | CHANGE | %CHANGE | CONTRACT | TIME (EDT) |

|---|---|---|---|---|---|---|

|

C 1:COM

Corn (CBOT)

|

USd/bu. | 453.25 | -3.50 | |||

|

W 1:COM

Wheat (CBOT)

|

USd/bu. | 575.75 | -10.25 | |||

|

O 1:COM

Oats (CBOT)

|

USd/bu. | 312.50 | -14.25 | |||

|

RR1:COM

Rough Rice (CBOT)

|

USD/cwt | 15.60 | -0.06 | |||

|

S 1:COM

Soybean (CBOT)

|

USd/bu. | 1,120.00 | +3.25 | |||

|

SM1:COM

Soybean Meal (CBOT)

|

USD/T. | 341.40 | +1.20 | |||

|

BO1:COM

Soybean Oil (CBOT)

|

USd/lb. | 44.38 | +0.01 | |||

|

RS1:COM

Canola (ICE)

|

CAD/MT | 622.50 | +4.40 |

Softs

| INDEX | UNITS | PRICE | CHANGE | %CHANGE | CONTRACT | TIME (EDT) |

|---|---|---|---|---|---|---|

|

CC1:COM

Cocoa (ICE)

|

USD/MT | 8,905.00 | -150.00 | |||

|

KC1:COM

Coffee 'C' (ICE)

|

USd/lb. | 225.00 | -5.35 | |||

|

SB1:COM

Sugar #11 (ICE)

|

USd/lb. | 19.16 | +0.14 | |||

|

JO1:COM

Orange Juice (ICE)

|

USd/lb. | 424.55 | +5.45 | |||

|

CT1:COM

Cotton #2 (ICE)

|

USd/lb. | 72.21 | -0.41 | |||

|

OL1:COM

Wool (ASX)

|

-- | -- | -- | |||

|

LB1:COM

Lumber (CME)

|

USD/1000 board feet | -- | -- | |||

|

OR1:COM

Rubber (Singapore)

|

USd/kg | 172.20 | -3.20 | |||

|

DL1:COM

Ethanol (CBOT)

|

USD/gal. | 2.16 | 0.00 |