The 2021 surge in global shipping costs was a canary in the coal mine for the persistent rise in inflation

It bears remembering that, as recently as the second half of 2021, the Federal Reserve considered that the surge in consumer price inflation would dissipate, with price increases returning to the Fed’s 2 percent target in 2022. In testimony before Congress, Fed Chair Jerome Powell affixed the now infamous “transitory” moniker to the ongoing price increases, which he ascribed to temporary supply bottlenecks and price declines in the early stages of the pandemic.

The Fed rejected the notion that price increases reflected an overheated economy—a view that was nevertheless already making the rounds in certain segments of Congress—and did not foresee any tightening before 2023 or 2024. New York Federal Reserve Bank President John Williams, who also serves as vice chair of the Fed’s policymaking committee, expected inflation to run at about 2 percent in both 2022 and 2023.

The Fed was not alone in misreading the implications of the data already available in 2021. The IMF, whose mandate is to take an independent view of developments and policies in member countries, described the inflationary surge in a blog by its (then) chief economist, Gita Gopinath, in the same terms as the Fed, pointing to transitory causes and taking comfort in the anchoring of inflation expectations. Like the Fed, the IMF did not mention in its updates the possibility of economic overheating and inflation persistence.

Fast-forward to spring 2022: the IMF’s World Economic Outlook revealed that the institution’s inflation projections were off by a factor of more than 3 for advanced economies and 2 for all other countries. These facts show that the inflation surprise was global.

To be fair, there were factors that were not foreseeable in 2021, such as supply chain disruptions related to China’s zero-COVID policy and commodity price increases owing to Russia’s invasion of Ukraine. There were also factors whose impact was difficult to predict with precision—for example, the unwinding of pandemic-era savings, which boosted demand. Economic forecasters, whether at the Fed or at the IMF, are not geopolitical or public health experts, and often the best they can do is to make an educated guess.

But while policymakers may get a pass for not factoring into their decisions what was unknowable a year ago, they should be held accountable for missing known drivers of inflation, especially those that pointed to enduring price pressures. It’s likely that the Fed has had to hike interest rates further to make up for its delayed start. Recession risks are very plausibly larger as a result, as are the adverse global spillovers from Fed policy.

So was there a smoking gun? In a recent study, my coauthors and I focus on a key driver of global inflation that was very evident already in 2021: the rapid increase in global shipping costs. By October 2021, indicators of the cost of shipping containers by maritime freight had increased by over 600 percent from their pre-pandemic levels, while the cost of shipping bulk commodities by sea had more than tripled.

HOW CONSUMERS THINK ABOUT INFLATION

HOW CONSUMERS THINK ABOUT INFLATION

What caused this remarkable increase? As manufacturing activity picked up following extended COVID-19 lockdowns, demand for shipping intermediate inputs (such as energy and raw materials) by sea increased significantly. At the same time, shipping capacity was severely constrained by logistical hurdles and bottlenecks related to pandemic disruptions and shortages of container equipment. Ports around the world lacked workers, who had to self-isolate after testing positive for COVID-19, and public health restrictions prevented truck drivers and ship crews from crossing borders.

While skyrocketing food and energy prices were making headlines, the surge in shipping costs seemed to pass largely under the radar, despite its potential inflationary impact. Our analysis suggests that a doubling of shipping costs causes inflation to increase by roughly 0.7 percentage point. Given the actual increase in global shipping costs during 2021, we estimate that the impact on inflation in 2022 was more than 2 percentage points—a huge effect that few central banks would dismiss.

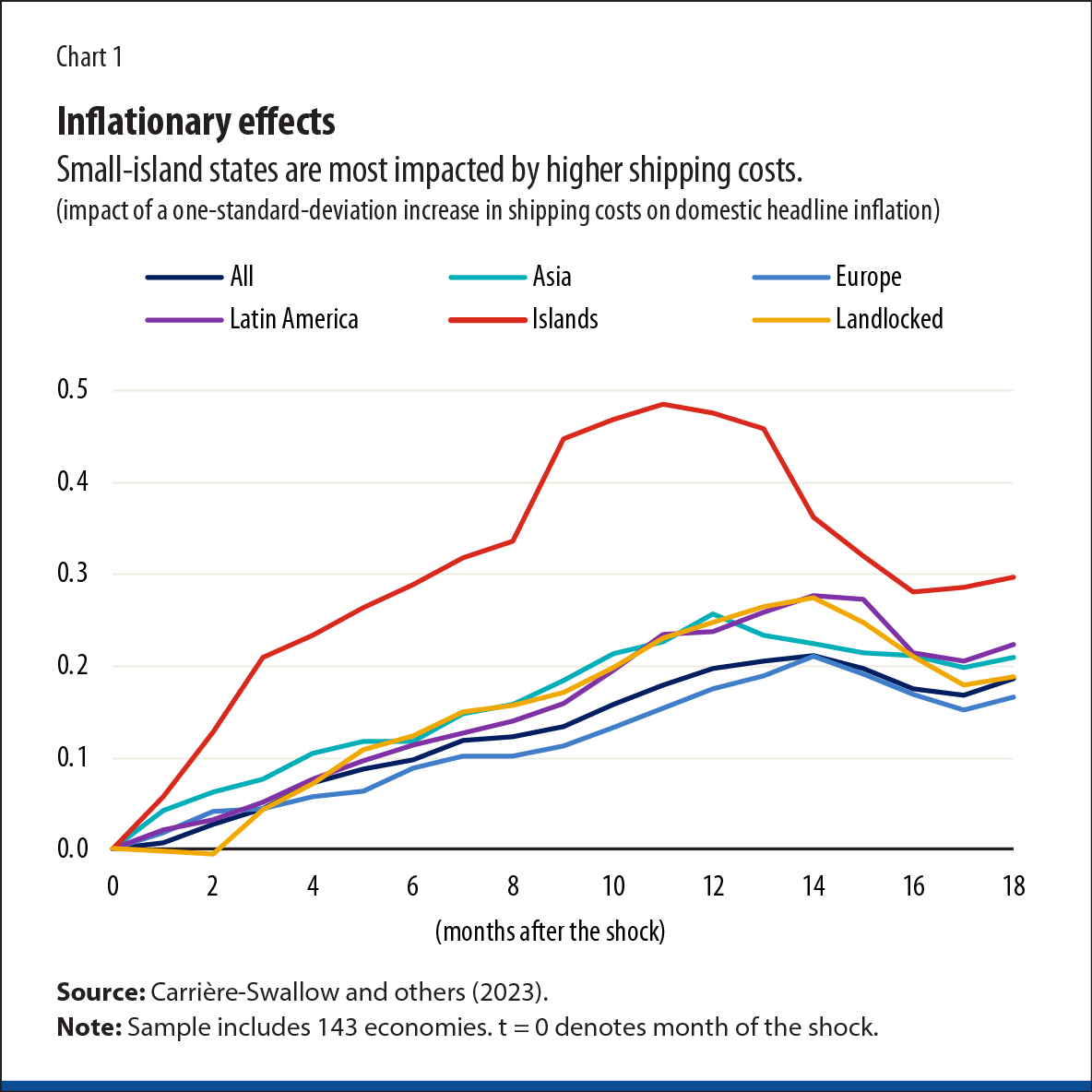

Our study also shows that the effect of the shipping cost shock on inflation is longer-lasting than the effects of commodity price shocks, peaking after about a year and lasting up to 18 months. By contrast, the impact of global oil prices on consumer price inflation peaks after only two months.

Of course, this average result varies across economies and regions, and it depends on monetary policy frameworks, particularly central banks’ track record of stabilizing prices and anchoring expectations, as well as on more structural features such as geography (which affects an economy’s remoteness and dependence on goods shipped by sea).

Our evidence suggests that the impacts of surging shipping costs are likely to be larger and more persistent in countries with less-anchored inflation expectations and weaker monetary policy frameworks. Lower-income countries and some emerging market economies may be more at risk than advanced economies with established price stability credentials.

Remote small-island states in the Pacific and the Caribbean are the most affected, according to our study’s results, with an inflationary transmission that is about double the average in the sample as a whole. This amplifies risks of wage-price spirals in such countries (a loop in which inflation leads to higher wage growth, fueling even higher inflation). When shipping costs surge, policymakers everywhere, but especially in such countries, may need to tighten their monetary policy preemptively.

The pandemic spike in shipping costs is more than a year behind us, and our research suggests that we should already have seen most of its inflationary impact by now. Our estimates, moreover, are symmetric, such that declines in shipping costs would tend to bring inflation down in the following year. The implication is for the big moderation in shipping costs in 2022 to contribute to a reversal of inflationary pressures.

Shipping costs’ role as a driver of global inflation is underrecognized. This needs to change. Shipping cost shocks can alert central banks tasked with ensuring price stability of dangers ahead and help them reduce the risk of once again falling behind the curve.