Comparing the Speed of U.S. Interest Rate Hikes

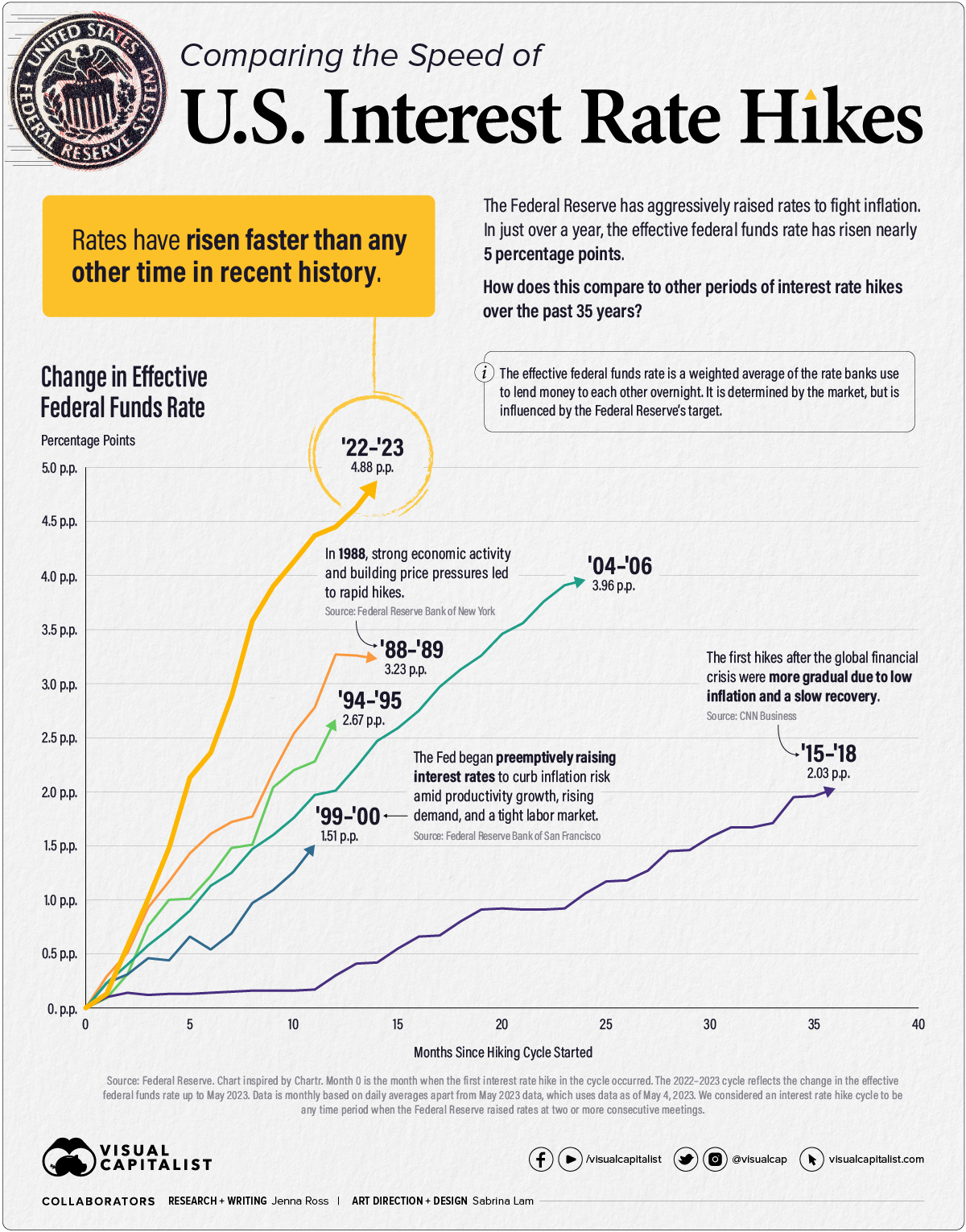

After the latest rate hike on May 3rd, U.S. interest rates have reached levels not seen since 2007. The Federal Reserve has been aggressive with its interest rate hikes as it tries to combat sticky inflation. In fact, rates have risen nearly five percentage points (p.p.) in just 14 months.

In this graphic—inspired by a chart from Chartr—we compare both the speed and severity of current interest rate hikes to other periods of monetary tightening over the past 35 years.

Measuring Periods of Interest Rate Hikes

We measured rate hike cycles with the effective federal funds rate (EFFR), which calculates the weighted average of the rates that banks use to lend to each other overnight. It is determined by the market but influenced by the Fed’s target range. We considered the starting point for each cycle to be the EFFR during the month when the first rate hike took place.

Here is the duration and severity of each interest rate hike cycle since 1988.

| Time Period | Duration (Months) |

Total Change in EFFR (Percentage Points) |

|---|---|---|

| Mar 1988 - May 1989 | 14 | +3.23 |

| Feb 1994 - Feb 1995 | 12 | +2.67 |

| Jun 1999 - May 2000 | 11 | +1.51 |

| Jun 2004 - Jun 2006 | 24 | +3.96 |

| Dec 2015 - Dec 2018 | 36 | +2.03 |

| Mar 2022 - May 2023* | 14 | +4.88 |

*We considered a rate hike cycle to be any time period when the Federal Reserve raised rates at two or more consecutive meetings. The 2022-2023 rate hike cycle is ongoing, with the latest hike made on May 4, 2023.

Real Interest Rates by Country

Real Interest Rates by Country

When we last compared the speed of interest rate hikes in September 2022, the current cycle was the fastest but not the most severe. In the months since, the total rate change of 4.88 p.p. has surpassed that of the ‘04-‘06 rate hike cycle. During the ‘04-‘06 cycle, the Federal Reserve eventually decided to pause hikes due to moderate economic growth and contained inflation expectations.

On the other end of the scale, the slowest rate hike cycle occurred in ‘15-‘18 after the Global Financial Crisis. Inflation, as measured by the Personal Consumption Expenditures (PCE) Index, was a mere 0.30% when the first hike occurred. Meeting transcripts reveal that Federal Reserve officials were concerned they may be raising rates too early. However, they agreed to the small quarter percentage point increase to show unity with Fed Chair Janet Yellen, who believed rising oil prices would eventually lead to higher inflation.

End of a Cycle?

The Federal Reserve’s small quarter-point rate hike on May 3 was influenced by a variety of factors. Below is a look at how select indicators have shifted since the first hike occurred in March 2022.

| March 2022 | March 2023 | |

|---|---|---|

| Year-Over-Year Inflation | 6.8% | 4.2% |

| Annual Growth in Labor Costs | 4.5% | 4.8% |

| Inflation-Adjusted Growth in Labor Costs | -3.7% | -0.2% |

| Annualized GDP Growth | 7.0% | 1.1% |

| Unemployment Rate | 3.6% | 3.5% |

| Over-the-Month Change in Employment (Revised data post-rate hike decision in brackets) |

+414,000 | +236,000 (+165,000) |

Source: Bureau of Labor Statistics, Bureau of Economic Analysis. Inflation is measured by the Personal Consumption Expenditures (PCE) Index. GDP growth for March 2022 is for Q4 2021, which is the data the Fed would have had access to when making its first rate hike decision. Employment has since grown by 253,000 in April 2023.

The unemployment rate remains low and job growth remains positive. Labor costs, in terms of wages and benefits, continue to grow. However, they are essentially flat on an inflation-adjusted basis. Inflation is still above the Federal Reserve’s 2% target, but it has slowed over the past year.

There are also reasons to be cautious. Economic growth has slowed considerably, and the Federal Reserve predicted in March of this year that a “mild recession” would begin later in 2023. Turbulence in the banking sector is also cause for concern, as tighter credit conditions will likely weigh on economic activity.

For now, it seems the Fed may have pressed pause on future interest rate hikes. Its latest statement said it would “determine the extent to which additional policy firming may be appropriate” rather than previous statements which anticipated future hikes.