So is spending billions of dollars to build thousands of miles of capture pipelines really necessary for the future of the ethanol industry?

Companies behind the multi-state pipelines have already invested millions of dollars in projects they say are needed to shrink the carbon footprint of ethanol plants and open up low-carbon fuel markets.

“There's going to be markets for all forms of ethanol produced — with carbon capture and sequestration and without carbon capture and sequestration,” Cooper said. “We remain very optimistic and very bullish about the future of ethanol. Yes, carbon capture is a huge opportunity. Yes, these pipelines are critically important to helping the industry lower its carbon intensity. But there's lots of other ways to do that as well.”

Some of those other ways include using solar and wind energy to power ethanol plants and having corn growers be more energy efficient, by using biodiesel or renewable diesel on the farm, for example.

“Using biodiesel or renewable diesel in your farm machinery — that's a great way to start. Using renewable electricity when available for irrigation, other things on the farm drying, things like that,” Cooper said.

Seven steps

A study done for the Renewable Fuels Association by Informed Sustainability Consulting, looked at ways for ethanol to achieve net zero emissions by 2050. The author of the study, Isaac Emery, said he ranked the action items based on effectiveness (the size of the carbon reduction), cost (carbon reduced per dollar spent), and feasibility (is the intervention on the market now or still in the research stage).

The rankings were:

- Renewable energy at plant: Using renewable electricity at 50% of ethanol plants by 2030, up to 90% in 2050.

- Fiber fermentation: Corn kernel fiber fermentation at 20% of dry mills by 2030, up to 50% by 2050.

- Efficiency: Better-than-business-as-usual industry-wide efficiency improvements and ethanol yields based on the historical trends of industry leading producers.

- Renewable energy on farm: Adoption of renewable electricity by 25% of corn suppliers in 2030, up to 90% in 2050.

- Carbon capture: Installation of carbon capture and sequestration technology at 40% of ethanol facilities by 2030, up to 90% by 2050.

- Manure power: Sourcing of bio-methane from manure biogas at 28% of ethanol facilities in 2030, up to 78% by 2050.

- Reduced tillage: Expanding reduced tillage practices to an additional 7.5% of corn farmers in 2030, 30% by 2050.

In an interview with Agweek, Emery explained that using a renewable resource like corn is good, but carbon capture makes it better.

“Yeast break down corn into CO2 and ethanol, and when that happens, you basically have half the carbon that ends up in the fuel and half the carbon that ends up going up as CO2. And that's not necessarily a problem for emissions by itself, because that CO2 started up in the atmosphere, got taken up by a corn plant doing photosynthesis and now it's just going back, so it's not like digging up oil and burning it and putting it in the atmosphere,” Emery said. “But it (carbon capture) gives us an opportunity to take that half the carbon from the corn plant basically and put that underground.”

Renewable energy ranks the highest, he said, because it is proven technology known to be cost effective.

“You don't have as many safety concerns or land ownership concerns,” Emery said. “It's much more straightforward than some of these kinds of pipeline projects.”

Other practices such as reducing tillage and improving soil are harder to quantify on carbon impact. But Cooper said that’s part of the future too.

“We see a tremendous amount of innovation and new technology coming around nutrient management and fertilizer application and reducing nitrous oxide emissions and other greenhouse gas emissions at the farm level. You tie all those things together and pretty soon you've got a low carbon corn or low carbon soybeans going to these facilities for further processing, and you end up with a renewable fuel that's got a very low or zero carbon footprint,” Cooper said.

Emery’s rankings were for the ethanol industry as a whole. He also ranked the action items for an individual ethanol plant, and in that scenario, carbon capture came out No. 2, still behind renewable energy.

One plant that has been able to implement carbon capture on its own is Red Trail Energy at Richardton, North Dakota. Its location in oil country is an advantage.

“Sometimes it's good to be lucky,” Gerald Bachmeier, CEO of Red Trail Energy, said during a tour of the plant after it started pumping CO2 underground in 2022. “If you threw a dart on a map and were looking for a place to do carbon sequestration, you couldn't find a better place.”

Bachmeier said companies buying low-carbon ethanol pay 20 to 30 cents more per gallon.

The premium price comes from markets, such as California, that have instituted a clean fuel standard, creating a higher demand for low-carbon fuels.

Market opportunities

“The driver is California state policy,” said David Ripplinger, associate professor at North Dakota State University, who focuses on energy.

While other states and Canada have started following California’s lead on low-carbon fuels, Ripplinger said there are opportunities for traditional ethanol elsewhere.

“Many other markets have significant opportunities,” Ripplinger said. He said that includes jet fuel.

Colorado-based Gevo is building a sustainable aviation fuel plant at Lake Preston, South Dakota. Gevo plans to use renewable energy and be net-zero on carbon emissions.

Cooper notes that there also is the push to up the standard ethanol blend from 10% to 15% in each gallon of gas, which will increase demand.

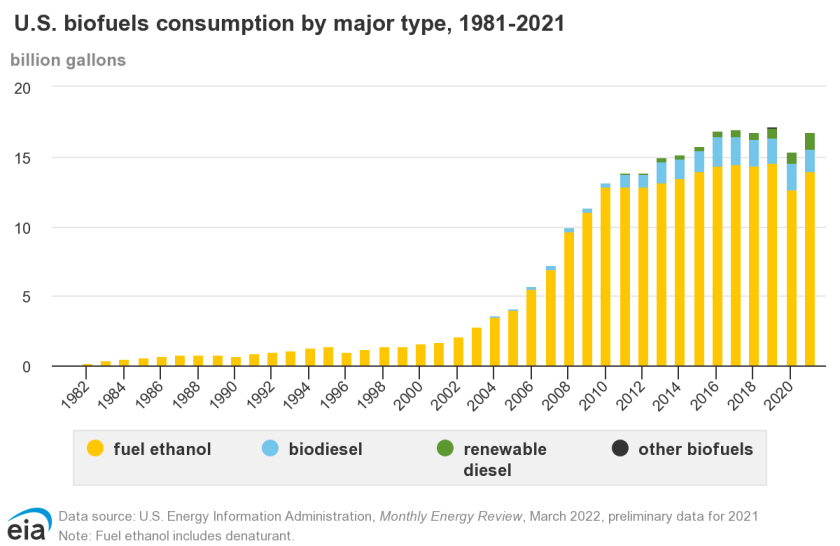

Other than a hiccup for the COVID-19 pandemic, ethanol production and consumption have been rising steadily in the United States.

“Ethanol is a great product, and it's got a lot to offer, and we believe that ethanol is going to be competitive and have strong demand worldwide for many, many years to come,” Cooper said.

Beyond ethanol

Brendan Jordan, vice president of transportation fuels at the Great Plains Institute, said while the focus is on carbon capture for ethanol now, it’s needed for other industries, too.

oduction as an example.

“There's parts of the industrial sector that we just cannot decarbonize without carbon capture,” Jordan said. “Unless we're going to give up concrete, if we want to reduce emissions, we've got to do carbon capture, and so that's true for a number of industrial sources.”