I know people often forget what they paid for groceries a few months ago, let alone last year. Things seem to be getting expensive every day, especially with our tough economic conditions in South Africa.

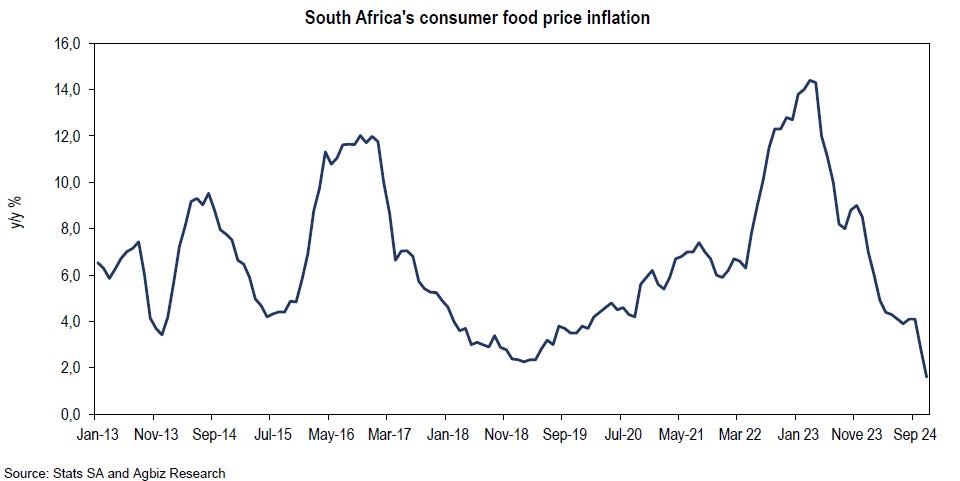

Still, I think it is essential to highlight welcome data developments when we see some. We are ending this year with food price inflation – the rate at which prices increase – cooling off the levels we have not seen in years.

For example, after slowing to 2,8% in October 2024, South Africa's consumer food price inflation decelerated notably to 1,6% in November, the lowest since October 2010.

The slowing down was broad-based, except for "oils and fats" and "fruit", which lifted slightly. As with the previous month, the slowdown was partly driven by base effects, as food price inflation was elevated this time last year. For example, this time last year, vegetable prices were elevated because of supply constraints due to load-shedding-related disruptions in some fields.

Moreover, the avian influenza outbreak constrained egg supplies, exacerbating price risks. This was also the case with meat. Thus, this time around, the supply has improved, and the challenges we faced last year have eased. It is for this reason that both vegetables and meat were in deflation in November 2024.

Also worth noting is that grain prices faced upward pressure last year following India's rice export ban. This year, India resumed rice exports, and prices slowed generally. We suspect the lower wheat prices have also added to the moderation of grain-related product prices.

While having eased remarkably in November 2024, grain-related products remain the upside risk to consumer inflation following a poor crop harvest due to the drought. For example, South Africa's 2023-24 maize harvest is estimated at 12,72 million tonnes, down 23% year-year due to the 2024 mid-summer drought. The white maize growing areas were the most affected. This is a staple crop that is also scarce in the world market. Thus, white maize prices remain elevated.

The additional challenge is the strong demand for white maize from Southern Africa, likely to continue through the first quarter of 2025. Still, we don't expect the potential grain-related product price increase to be substantial as their forecasts point to the ample global wheat and rice harvest in 2024-25, which may cushion the region as substitutes.

Narratives that underpin the consumer food inflation outlook in South Africa

Narratives that underpin the consumer food inflation outlook in South Africa

Favourable weather prospects bode well for cooling food prices

Also worth noting is that South Africa is approaching a generally favourable agricultural season on the back of expected La Niña rains. Various regions have already started planting and have received a fair amount of rain that improved soil moisture.

The farmers are also optimistic and plan to plant a slightly bigger area for summer grains and oilseed. For example, the data released by the Crop Estimates Committee in October showed that South African farmers intend to plant 4,47 million hectares of summer grains and oilseeds in the 2024-25 season. This is up mildly by 1% from the previous season.

Overall, South Africa's food price inflation has slowed notably, and the forecasts for 2025 are generally favourable. The only main risk in the near term is the higher grain prices, specifically white maize, due to tight supplies following a poor 2023-24 harvest.

Still, this will be short-lived, and the new 2024-25 production season looks promising and will help slow the food price inflation in the later months of 2025.