Poultry is one of the cheapest protein sources for the growing population of the east and southern Africa region. That makes soybeans critical to food security in the region, as they are an important input in chicken feed.

Soybean pricing and production dynamics have been challenging for Zambia and Malawi, threatening poultry production in the region.

Poultry feed makes up 60%-70% of the total cost of poultry production. Soybean prices directly affect the affordability of poultry and the ability of producers to be competitive. Small-scale independent poultry producers in particular have a hard time because they buy feed from the open market and are too small to determine prices. Large producers source feed from their own operations and determine soybean prices.

Figure 1: From soybeans to poultry

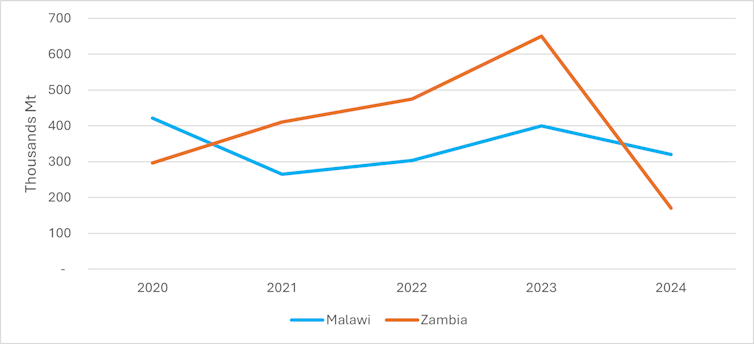

Zambia and Malawi are the key soybean producers in east and southern Africa. Both countries were hit hard in 2024 by climate change related weather and by the behaviour of players in the soybean market, including processors and traders.

Zambia’s soybean production fell by 74% because of poor rains and also because of farmers being squeezed. Large buyers had negotiated very low prices in previous years, so farmers planted less.

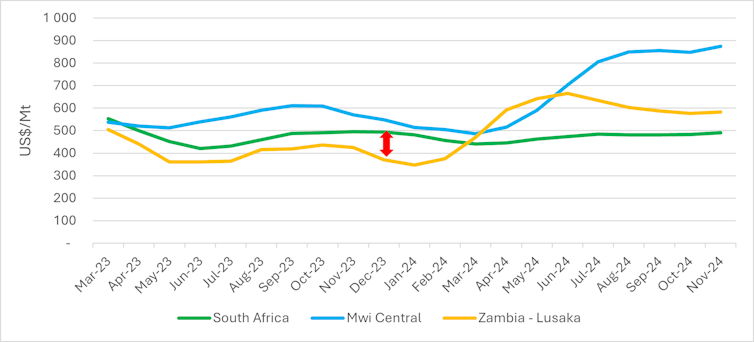

Malawi’s production also fell (20%), but much less than Zambia’s. Yet the surge in soybean prices in Malawi by 48% between May 2024 and November 2024 was out of proportion with the drop in production, and even surpassed Zambian prices (Figure 2). Malawian prices were the highest in the region, even though it produced enough to export.

We are economists at the African Market Observatory, which monitors prices of staple foods and conducts research on market dynamics. We analyse market concentration and barriers to entry, within and across countries in east and southern Africa, and we do in-depth field work.

Our work shows that competition issues, such as the ability of large buyers to influence prices and high margins, are at the heart of the surge in prices and low production in Malawi and Zambia. The climate-related weather effects are an additional factor.

Figure 2: Soybean prices in Zambia, Malawi and South Africa (benchmark) (3-month moving averages)

Market outcomes

In Zambia, dominant buyers of soybean offered farmers very low prices during the 2023 season – well below US$400/t and the South African benchmark (Figure 2). This meant that farmers planted less than half the 2023 crop in the 2024 season.

Crops were also affected by poor rainfall. Malawi’s 2024 production fell by 20% because of the worst drought in 100 years. The drop in production was lower than expected, demonstrating that farmers can adapt to weather changes. Prices still rose, however, driven by the highly concentrated soybean trading and processing market.

Cheapest source of proteins

Poultry is one of the cheapest sources of protein and has one of the lowest environmental impacts. It is essential that the value chain works well from feed to chicken rearing and becomes more resilient to extreme weather events.

The experience of 2024 shows what can go wrong.

Poultry demand in sub-Saharan Africa is expected to grow more than fourfold by 2050. Producers will need affordable feed.

Among them are many small-scale independent producers who rely on competitive markets for their inputs. Yet we found that with the escalating soybean and feed prices in Malawi from late 2021, and higher prices for day-old chicks, small independent producers had negative margins, meaning they made a loss in the second half of 2021. High feed prices undermine the competitiveness of Malawi’s poultry industry.

Aside from South Africa (which relies on genetically modified soybean), Zambia and Malawi have been the largest producers in the region. These countries have been exporting around half of their production (including soycake) to neighbouring countries with larger populations such as Tanzania and Kenya.

Insect meal: A soya alternative in the poultry industry

Insect meal: A soya alternative in the poultry industry

Zambia’s production plummet

Between 2020 and 2023, Zambia’s soybean production grew from 297,000 tonnes to 650,000 tonnes (Figure 3). In 2024, its production collapsed by 74% to 170,000 tonnes. This sharp decline was primarily due to farmers opting to plant less soybean because of the low prices offered from processors in 2023 (Figure 2). Farmers bought 50% less soybean seed for the 2024 season than the 2023 season.

Figure 3: Soybean production in Zambia and Malawi

With limited storage facilities available for farmers in most countries in the region, including Zambia, farmers typically have to sell to traders and processors shortly after harvest.

In Zambia, soybeans are produced by many small farmers, so they compete to sell their crop to a few main processors in a concentrated market. As a result, these processors have greater power to influence the terms of trade, such as price. This was especially evident in 2023 when processors offered farmers lower prices (Figure 2).

Poor rainfall linked to the 2023/24 El Niño phase of the El Niño Southern Oscillation, which is the warming of the central to eastern tropical Pacific Ocean, causing drought in southern Africa while inducing heavy rainfalls and floods in eastern Africa, did have an impact across southern Africa, including Malawi and Zambia. While Kenya, Uganda and Tanzania recorded above average rainfall, their soybean output is low.

Resilience to climate change impacts requires deepening and diversifying agriculture production across countries and regional trade to meet demand.

Soybean prices in Malawi remain high but Zambia’s prices stabilise

Malawi’s prices increased rapidly to over US$700/tonne in June 2024, surpassing Zambia’s, and continued to rise to almost $900/tonne at the end of the year, far above other countries in the region. The reason couldn’t be reduced production from poor rainfall, because production still exceeded local demand. This happened even as the Malawi government put export restrictions on soybeans (but not soymeal). The price surge raises competition concerns in Malawi, where trading and processing is highly concentrated. In theory, highly concentrated markets are characterised by high prices, due to a lack of price competition.

By comparison, Zambia’s prices moderated because of imports. In addition, the low soybean prices offered to farmers in 2023 also meant that processors had crushed surplus soybeans, thereby building up soymeal stock. This reduced the demand for soybeans, as did power cuts in Zambia, which limited crushers’ operations.

Urgent next steps

Soybean developments over 2024 show the need to consider how competition issues within and across borders can undermine the resilience of regional food markets and hinder the ability of small producers to compete. Zambia is currently conducting a commercial poultry market inquiry. But a regional approach in monitoring markets and tackling anti-competitive conduct is necessary to support poultry production.