Japan is a small-scale producer of grain, with a relatively large population, making it an important import customer. Rice remains the most important part of the national diet.

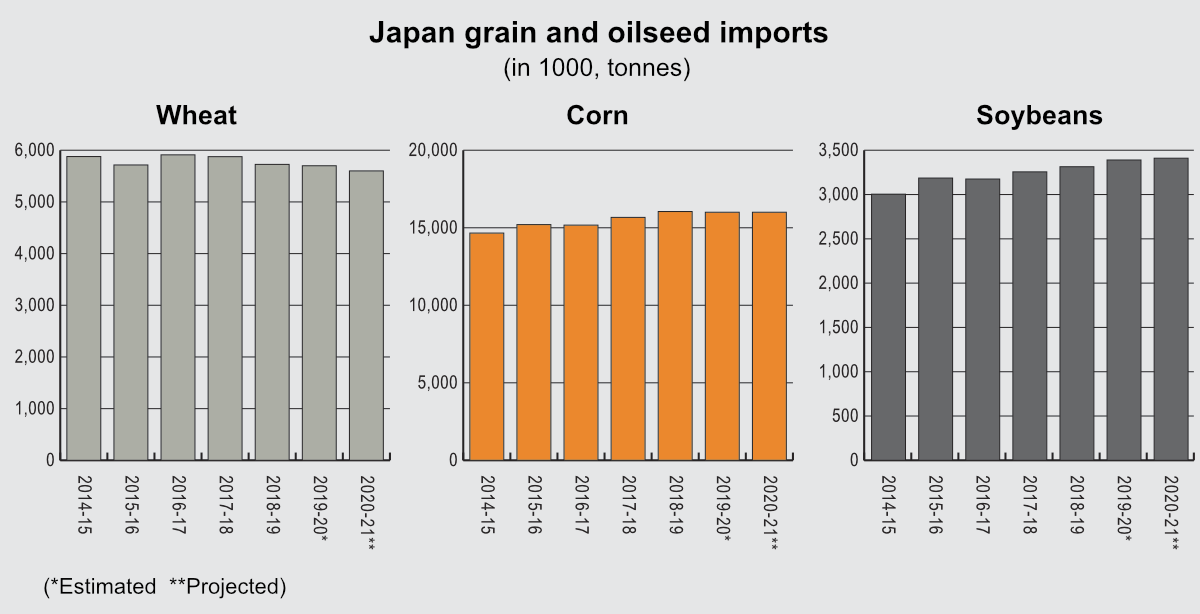

Japan’s grains production is too small to figure in the International Grains Council’s (IGC) forecasts. The IGC does put the country’s total grains imports in 2020-21 at 24.2 million tonnes, up from 23.9 million in 2019-20. The 2020-21 figure includes an unchanged 5.8 million tonnes of wheat and 16.5 million of maize, up from 16.3 million in 2019-20. Imports of barley are put at 1.2 million tonnes, the same level as in the previous year.

The country is also set to import 600,000 tonnes of sorghum in 2020-21, up from 500,000 the year before, and 45,000 tonnes of oats, up from 40,000. The IGC forecasts Japanese imports of rye in 2020-21 at 22,000 tonnes, up from 15,000 the previous year.

The IGC forecasts Japanese rice production at an unchanged 7.4 million tonnes in 2021, with imports at 700,000 and exports at 100,000 tonnes, both figures also unchanged. Imports of rapeseed in 2020-21 are forecast at 2.3 million tonnes, again the same as in the previous year, with soybean imports at 3.4 million, up from 3.3 million in 2018-19.

In an annual report on the sector dated March 19, the attaché put Japan’s total maize production at some 2,000 tonnes in 2020-21, on an area of less than 1,000 hectares.

“Roughly 4.5 million tonnes of whole crop silage corn is produced on 95,000 hectares each year,” the attaché said.

The Foreign Agricultural Service in Tokyo expects maize consumption to remain stable in 2020-21 at 16 million tonnes, with 12.3 million used for food and feed and 3.7 million for seed and industrial purposes. The attaché expects maize imports at an unchanged 16 million tonnes.

“The United States is the primary supplier of corn to Japan, but imports from Brazil spiked during Japan’s winter months,” the report said. “A large, high-quality crop coupled with a weak Brazilian Real paved the way for a short-term increase of imports from Brazil between October 2019 and January 2020, expanding Brazil’s share of the Japanese corn market to over 70%.”

The attaché forecasts an 870,000-tonne wheat crop in 2020-21, well down on the previous year’s record 1.1 million, bolstered by favorable weather, despite an unchanged area.

“This stability is attributable to wheat’s popularity as a rotation crop or a second crop after rice and MAFF’s support payments,” the attaché said, referring to the Japanese farm ministry. “Similar to barley, to incentivize the conversion of table rice production to wheat production, MAFF provides support payments of 35,000 yen (approximately $335 USD) per 0.1 hectare based on the planted area of wheat in rice paddies.”

The report forecasts food, seed and industrial use of wheat at 5.65 million tonnes in 2020-21, unchanged from the previous year.

“Japan’s population has been decreasing at an average rate of 0.16% over the last eight years and people over 70 now account for more than 20% of the population,” the report said. “Consumers are eating more protein and fat and fewer carbohydrates, although to date most of the shift away from carbohydrates has been at the expense of rice.

“Despite these changes, Japanese wheat consumption had been relatively stable, in part due to increasing numbers of visitors to Japan, which has welcomed a surge of inbound visitors, steadily increasing each year from 8.4 million people in 2012 to 31.8 million in 2019, helping to stabilize wheat consumption.”

However, industry sources believe that the Japanese wheat flour market has plateaued and consumption, driven by demographic changes, is now in decline, the attaché added.

The report explained the stable forecast by saying that “a projected recovery in inbound visitors will be nullified by Japan’s continued population decline and changes in dietary preferences.”

“Most food wheat is imported from the United States, Canada and Australia within the WTO quota and through the MAFF operated state-trading system,” the attaché said.

In addition to the WTO quota, Japan established quotas with reduced markups under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the Japan-EU EPA (Economic Partnership Agreement), and the United States Japan Trade Agreement (USJTA).

“These quotas are not expected to influence total imports as demand is projected to be flat,” the attaché said. “However, industry sources are concerned about the wheat supply from Australia due to the ongoing drought and indicated they may have to seek alternative suppliers for semi-soft wheat.”

Japan: An illegal ivory trader’s haven – new report

Japan: An illegal ivory trader’s haven – new report

Japanese exports of wheat products, predominantly wheat flour, have been stable, the attaché said, putting the 2020-21 level at 280,000 tonnes.

According to information supplied to World Grain by Takanobu Urata of the 22 member Japan Flour Milling Association, the country had 74 millers in 2018, compared with 90 in 2013. They produced 4,834,000 tonnes of flour at a capacity usage rate of 73.6% in 2018, compared with 4,868,000 tonnes at 70.4% utilization in 2013. The share of the big four millers is 73.6%, while the big 13 have 90%.

Rice trends

The attaché forecasts a 600,000-tonne fall in rice consumption in 2020-21, to 8.25 million tonnes, “as the steady decline of table rice consumption in Japan continues.”

“According to MAFF, the decrease in table rice consumption has accelerated since MY 2016-17 and is declining at annual rate of 91,000 tonnes,” the report said. “The accelerated pace of decline is attributed to population decline, reduced carbohydrate intake, and a year-on-year increase of table rice prices since MY 2015-16.”

High table rice prices adversely effect rice consumption in the foodservice and processing industries as serving portions are decreased to maintain low prices, it said.

“While total rice consumption continues to decline, some consumption has shifted from rice cooked at home to ready-to-eat rice,” the report said.

It also noted that “production of frozen rice has also grown 80% over the last decade, reaching a total of 178,000 tonnes (product volumes) in 2019.”

Oilseeds output rises

In an annual report, dated April 1, on the oilseeds sector, the attaché forecast total soybean production in 2020-21 at 235,000 tonnes, compared to 212,000 the year before, while the rapeseed crop is seen at an unchanged 4,000 tonnes.

“Driven by the decline in soybean prices, Japanese farmers, particularly in Hokkaido, have a marginal preference for planting adzuki beans and other legume rotation crops, over soybeans,” the attaché said. “Soybeans are Japan’s most heavily consumed oilseed.

“Three large oil crushers (Nisshin Oillio, J-Oil Mills, Showa Sangyo) produce over 80% of Japan’s edible vegetable oil.”

Biotech and biofuels

Japan remains one of the world’s largest per-capita importers of food and feed produced using modern biotechnologies, the attaché said in a March 30 report.

“In 2019, Japan imported 16 million tonnes of corn, 3.2 million tonnes of soybeans, and 2.4 million tonnes of canola, products that are predominately genetically engineered,” the report noted.

Japan’s annual biofuel target of 500 million liters (crude oil equivalent) for the transport sector was reached on time in 2017 and continues unchanged this year, the attaché said in a report dated Nov. 6, 2019.

“Following a 2018 revision of environmental standards for bioethanol, Japan began importing ETBE made from US corn ethanol for the first time in July 2019, but its ethanol blend rate remains among the lowest of countries with a fuel ethanol program,” the report said.